Russian authorities temporarily suspend operations at the CPC terminal in the Black Sea. Possible implications for Romania?- Analysis by the MARITIME SECURITY FORUM

Russia has implemented additional security measures at its main oil loading terminals, which are essential to its economic activity. This week, some of these measures led to the temporary suspension of oil ports in the Black Sea, affecting exports from both Russia and Kazakhstan. This will (possibly) disrupt oil supplies to refineries owned by KMG International, which is owned by Kazakhstan’s national oil and gas company, KazMunayGas, in Romania.

The halt in oil imports from Kazakhstan could have major implications for Romania, given that this country has been its main supplier of crude oil in recent years. Here are some of the possible effects:

Economic and energy implications

- Higher fuel prices: Romania may have to import oil from more expensive or more distant sources, which would lead to price increases across the board.

- Pressure on domestic production: With only 25–27% of demand covered by local production, refineries would be forced to seek quick alternatives.

- Impact on refineries: Petromidia, Petrotel, and Petrobrazi are largely dependent on Kazakh oil. A halt in deliveries could lead to reduced processing capacity.

Geopolitical implications

- Tensions with Russia: Kazakh oil reaches Romania via the CPC pipeline, which crosses Russia. Moscow has imposed additional restrictions and controls, including FSB approval for foreign vessels.

- Search for alternative routes: Kazakhstan is exploring options via Azerbaijan, Georgia or the Caspian Sea, but these are more expensive and logistically complicated.

Implications for KazMunayGas and Rompetrol

- Risks for Kazakh investments: Proposed tax measures in Romania (increased taxes on profits and dividends) could prompt KazMunayGas to reassess its presence in the country.

- Possible closure of refineries: If operational efficiency declines, there is a risk that the Petromidia and Vega refineries could be closed or sold.

Kazakhstan’s oil export routes are illustrated below:

Crude oil supply alternatives

| Țară sursă | Avantaje | Provocări |

| Azerbaidjan | Proximitate geografică, relații bune | Capacitate limitată de export, competiție regională |

| Arabia Saudită | Rezerve mari, livrări stabile | Costuri mai mari, distanță mare |

| Irak | Petrol accesibil și relativ ieftin | Instabilitate politică și logistică |

| Libia | Petrol de calitate (light crude) | Riscuri geopolitice și variabilitate în producție |

| Norvegia | Furnizor din UE, standarde înalte | Prețuri ridicate, exporturi mai reduse în regiune |

| SUA (WTI) | Diversificare strategică | Transport maritim lung și costisitor |

How would the fuel market in Romania be affected?

- Higher gasoline and diesel prices, depending on the origin of the crude oil and import taxes

- Distribution adjustments — companies would need to find new logistics routes and unloading terminals

- Possible capacity reductions at refineries if the available crude oil does not match existing technological configurations

- The market could be opened up to new players, leading to either increased competition or consolidation

In the absence of sufficient export pipeline capacity, Russia is transporting oil by sea to its remaining customers, using a limited number of locations that allow deep-draft tankers to load. These locations may be exposed to risks of sabotage. The Ust-Luga terminal in the Baltic Sea was involved in an incident involving a mine on an ammonia carrier, and seven other Russian ships have been affected by explosions since December. Various sources attribute these incidents to the Ukrainian secret services.

In response, the authorities, at the initiative of President Vladimir Putin, requested that the FSB impose prior verification and authorization for all arriving vessels, including underwater inspections of ships, a more costly but detailed procedure.

These regulations led to the temporary closure of the Novorossiysk terminals, including the Caspian Pipeline Consortium (CPC) buoys, which handle up to 1.5 million barrels per day of oil from Kazakhstan, representing over one percent of global crude oil supplies. According to Reuters, the terminals resumed operations on Thursday.

The new security requirements further complicate the export process for Russia. With the introduction of the 18th round of European sanctions, the G7 price cap is now calculated on a variable basis and is low enough to exclude a significant portion of the Greek oil fleet, which previously transported about half of Russian oil. In this context, Russian exporters may become more dependent on an alternative fleet of tankers that do not use Western insurance and classification services.

According to Elisabeth Braw, a shipping consultant and member of the Atlantic Council, one possible solution to reduce the risk of incidents would be Russia’s withdrawal from Ukraine, but this scenario is unlikely given the current duration of the conflict.

The Petromidia refinery, the largest in Romania, mainly imports crude oil from Kazakhstan via the Midia marine terminal, operated by the KMG International group, owned by Kazakhstan’s national oil and gas company, KazMunayGas.

How crude oil reaches Petromidia:

- Through the marine terminal located 8.6 km off the Black Sea coast, capable of unloading ships of up to 160,000 tons

- The Caspian Pipeline Consortium (CPC) pipeline, which transports Kazakh oil to the port of Novorossiysk, where it is loaded onto ships

· The Caspian Pipeline Consortium (CPC) is the operator of the 1,500 km Tengiz-Novorossiisk pipeline, which passes through Russia and brings Caspian oil to the Black Sea and the marine terminal in the Russian port of Novrossiisk, where it is loaded onto offshore tankers via three floating loading points located 5 km off the coast.

· The Caspian Pipeline Consortium (CPC) loaded the first tanker at the offshore terminal on October 13, 2001.

· In total, from 2001 to January 9, 2022, 766,973,131 net tons of crude oil were delivered to world markets via the Tengiz-Novorossiysk pipeline system. Of this oil, 668,967,665 tons came from Kazakhstan and 98,005,466 tons were produced in Russia. The total number of tankers handled during this period amounted to 7,246.

· The Midia terminal has been used to supply the refinery with over 55 million tons of raw materials over the past 15 years

In case of interruptions or overhauls, the refinery has:

- Operational and emergency crude oil stocks

- Access to additional storage facilities in the Port of Constanța

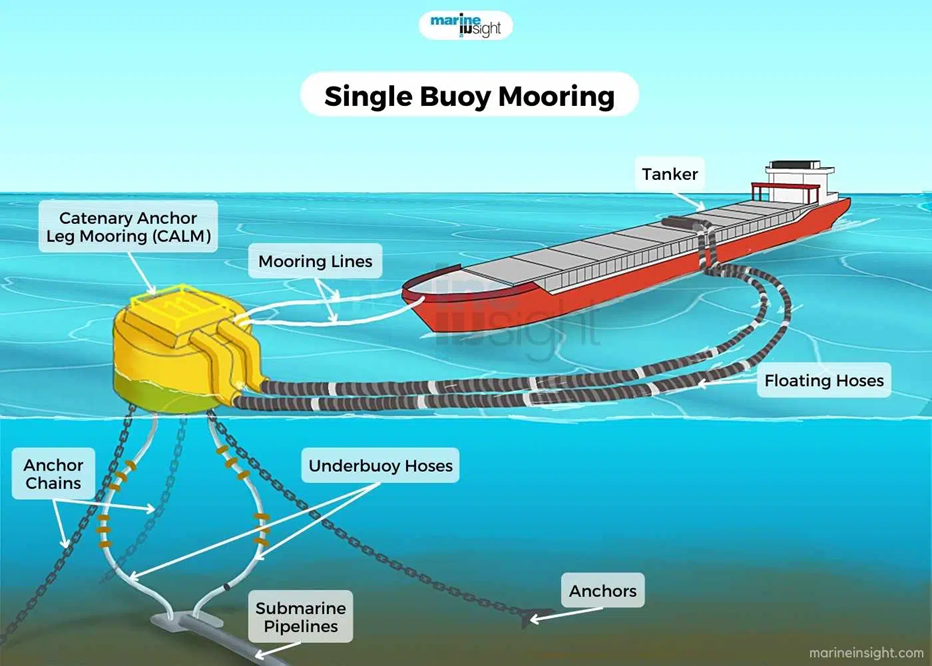

The Midia marine terminal operates as a Single Point Mooring (SPM) offshore unloading system — a single mooring buoy located 8.6 km off the Black Sea coast, which allows crude oil to be transferred directly from oil tankers to the Petromidia refinery.

Photo source: Marine Insight

How the operation works:

- The ship connects to the SPM buoy via a flexible mooring system that allows it to rotate freely around the buoy, adapting to wind, waves, and currents.

- The crude oil is transferred through two sets of floating hoses, then through subsea hoses to a manifold located at a depth of 24 m.

- From there, the crude oil is pumped through a 1 m diameter subsea pipeline directly into the refinery’s tank farm.

Capacity and safety:

- The maximum transfer rate is 7,000 m³/h, which allows a ship of 80,000–160,000 tons to be unloaded in 24–36 hours.

- The terminal is designed to withstand a “100-year storm” without any ships being moored.

- The equipment is powered by solar and wind energy, and the buoy is monitored by real-time weather and marine sensors.

Operation and maintenance:

- There is no permanent staff on the buoy; teams arrive with tugboats for connection and supervision.

- Maintenance is carried out by qualified divers and underwater robots (ROVs) in accordance with international standards.

MARITIME SECURITY FORUM